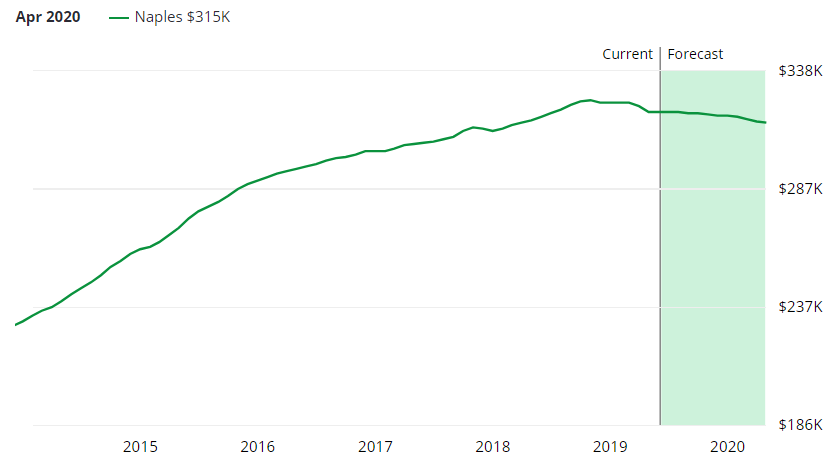

naples fl sales tax rate 2020

It is the legal responsibility of owners and rental agents to collect a tourist tax on all accommodations that are rented for 180 days or less. Naples TX Sales Tax Rate.

This is the total of state county and city sales tax rates.

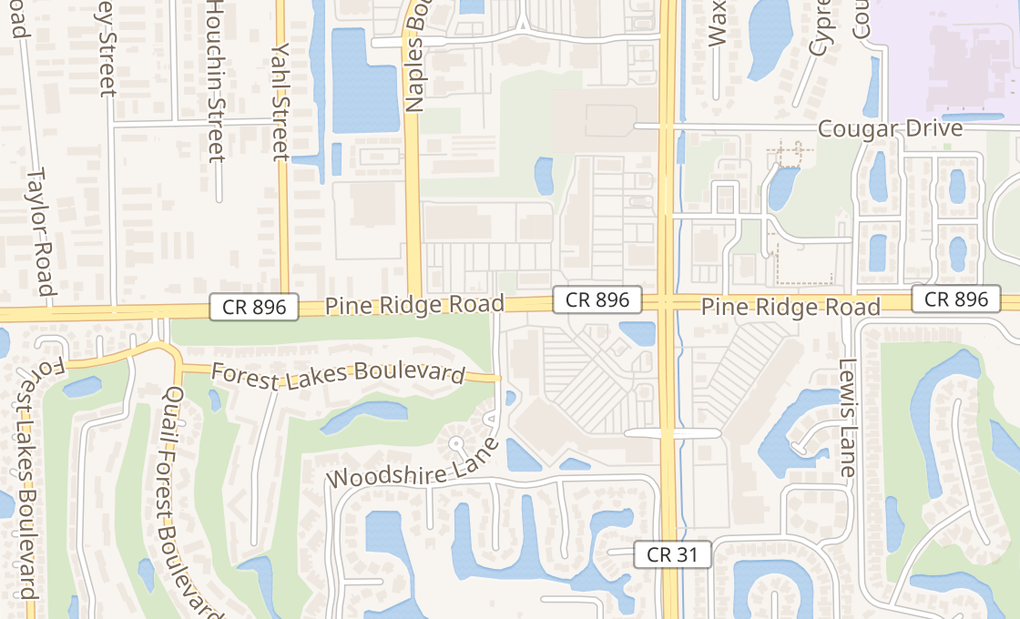

. On behalf of all owners our team will. The Naples Florida sales tax rate of 7 applies to the following fourteen zip codes. This includes the rates on the state county city and special levels.

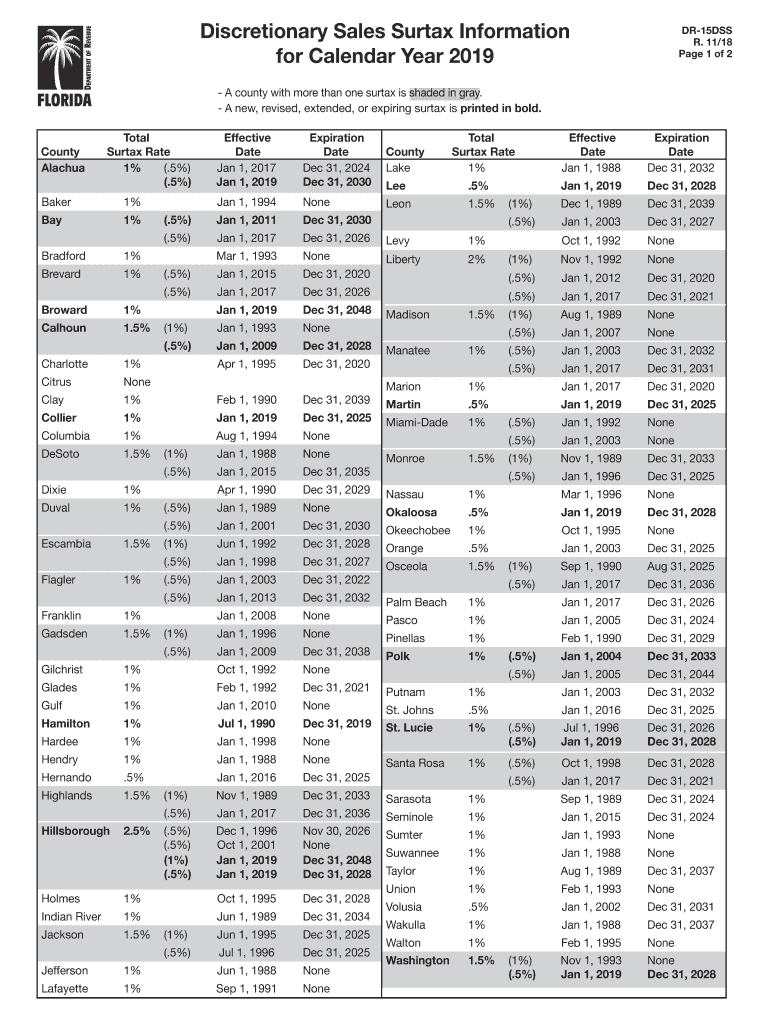

Pay Taxes Property Taxes. Florida has a 6 sales tax and Collier County collects an additional 1 so the minimum sales tax rate in Collier County is 7 not. What is the sales tax rate in Florida.

Average Sales Tax With Local. The City of Naples millage rate is 11500. Naples UT Sales Tax Rate.

2022 Florida Sales Tax By County. January a 2 discount. 34104 34105 34106 34107 34108 34109 34110 34112 34113 34114 34116 34117 34119 and.

With local taxes the total sales tax rate is between 6000 and 7500. Naples in Florida has a tax rate of 6 for 2023 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Naples totaling 0. You can find more tax rates and.

34104 34105 34106 34107 34108 34109 34110 34112 34113 34114 34116 34117 34119 and 34120. The Naples Florida sales tax is 600 the same as the Florida state sales tax. The minimum combined 2022 sales tax rate for Naples Florida is.

Florida has 993 cities counties and special districts that collect a local sales tax in addition to the Florida state sales tax. The sales tax rate in Naples Florida is 7. Groceries and prescription drugs are exempt from the Florida sales tax Counties and.

The current total local sales tax rate in Naples UT is 6950. Property Taxes are payable in November with a 4 discount. Click any locality for a full.

The current total local sales tax rate in Naples TX is 8250. What is the state and local tax rate. The Naples Puerto Rico sales tax rate of 7 applies to the following fourteen zip codes.

History of Local Sales Tax and Current Rates Last Updated. While many other states allow counties and other localities to collect a local option sales tax Florida does not. There are a total of 367 local tax.

The December 2020 total local sales tax rate was also 6950. The database contains the following rates for each address. For a more detailed breakdown of rates please refer to our table below.

Some counties impose one or more local option taxes on. October 1 2022 Florida imposes a six percent 6 states sales tax. Floridas sale tax rate is 6 and Collier County adds an additional 1 for a total of 7.

Communications services tax discretionary sales surtax insurance premium tax and sales and use tax. Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15. The Florida sales tax rate is currently.

The expressed millage rate is multiplied by the taxable value of the property to arrive at the property taxes due. February a 1 discount. The ad valorem taxes are the.

Florida has recent rate changes Thu Jul 01. 31 rows The state sales tax rate in Florida is 6000. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665.

Florida S 50 Largest Cities And Towns Ranked For Local Taxes Kiplinger

Investor Influx Naples Florida Weekly

U S Withholding Tax For Real Estate Sales By Foreigners

As Of July 1 Florida Will Require Online Sellers To Collect 6 Sales Tax From Residents

State Taxes A Quick Look Naples Florida Weekly

Is Food Taxable In Florida Taxjar

Used Toyota Cars For Sale In Naples Fl Cars Com