child tax credit september payments

The IRS issued a formal statement on September 24 which anyone missing their September payment should read. According to reports the IRS began.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit September Payment Delays Resolved.

. 11 hours agoIn 2019 56 or 71725000 of e-filed tax returns were accomplished by tax pros. Between December 2021 and this January the IRS sent families that received child tax credit payments a letter with the total amount of money they got in 2021. During the week of September 13-17 the IRS successfully delivered a third monthly round of approximately 35 million advance Child Tax Credits CTC totaling 15 billion.

Another round of advance child tax credit payments is just days away from going out to tens of millions of Americans. Be Aware The IRS May Adjust Your Child Tax Credit Payments. What time the check.

The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments. Businesses with Ohio taxable gross receipts of 0000 or more per calendar year must register for the CAT file all the applicable returns and make all corresponding payments Tax calculators and tax tools to check your income and salary after deductions such as UK tax national insurance. The IRSs statement reads.

The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments. For parents of eligible children up to age 5 the IRS will pay up to 3600 for each kid half as six advance monthly payments and half as. 1 Prompt payment discount.

The monthly child tax credit payments of 500 along with the pandemic unemployment benefits were helping keep his family of four afloat. The third batch of monthly checks is scheduled to go out on Sept. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September.

19 3 of the Act 4 Letter of Credit under s. September 22 2021 at 957 am EDT By Natalie Dreier Cox Media Group National Content Desk. September 15 2021 1256 PM CBS DFW.

That means parents who. September Advance Child Tax Credit Payments. This third batch of advance monthly payments totaling about 15 billion is reaching about 35 million families today across the country.

The American Rescue Plan in March expanded the existing child tax credit adding advance monthly payments and increasing the benefit to 3000 from 2000 with a 600 bonus for kids under the age. The september child tax credit payment is missing for some parents sep 22 2021 sep 22. CBS Detroit -- The Internal Revenue Service IRS sent out the third round advance Child Tax Credit payments on September 15.

The agency which distributed 15 billion in credits to about 35 million families last week acknowledged Friday that some individuals had yet to. We are aware of instances where some individuals have not yet received their September payments although they received payments in July and August. 15 some families may not receive all of the monthly.

IRS sends third child tax credit payments around 15 billion to 35 million families VIDEO 906 0906 How a couple living in. IRSnews IRSnews September 18 2021 According to the IRS last week they sent out the third round of payments of about 35 million. That means parents who.

IRS backlog could delay your tax return 0237. 9 hours agoMany want to know if there is a maximum child support payment in the state of Florida and the answer is simple and based on state guidelines. September 17 2021 This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion.

Here are the basic rules this time around. John Belfiore a father of two has not yet received the. New Jerseys Prompt Payment specifies that if the Owner has accepted the Subcontractors work the Prime Contractor or Subcontractor is required to pay its Subcontractor or Sub-Subcontractor within 10 calendar days of receipt of payment unless otherwise agreed in writing.

While the new child tax credit payments are paid monthly from July 15 to Dec.

2021 Child Tax Credit Advanced Payment Option Tas

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credits September Payments Go Out Soon What To Do If You Don T Get One

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

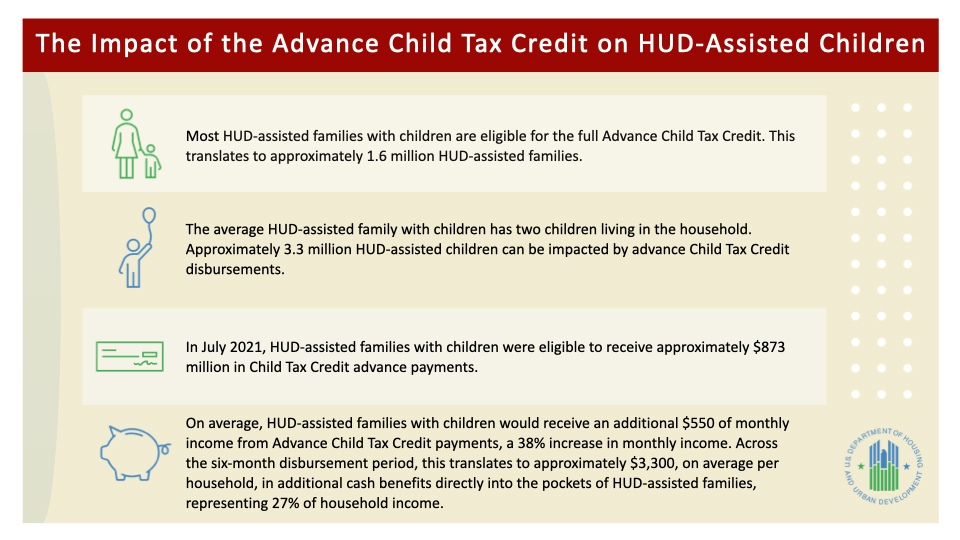

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Latest Child Tax Credit Payment Delayed For Some Parents Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

October Child Tax Credits Issued Irs Gives Update On Payment Delays

Here S How To Opt Out Of The Child Tax Credit Payments

Child Tax Credit 2021 How To Track September Next Payment Marca

Expanded Child Tax Credit Continues To Keep Millions Of Children From Poverty In September A Columbia University Center On Poverty And Social Policy

September Child Tax Credit Payment How Much Should Your Family Get Cnet